Key point for Tolu Minerals Ltd. (TOK :ASX).

- Good progress on mine reopening made since listing in November

- Condition and refurbishment rate of plant and equipment above expectations

- New drilling rigs and other essential equipment ordered and/or delivered

- Successful recruitment of key management and operational staff

- First `bulk samples' from defined stopes likely to be delivered to the gravity circuit in 200,000tpa mill in June Half 2024

- 23km link road already >30% complete and ahead of the August 2024 target

- Two exploration programs completed in 2023 for post-IPO release

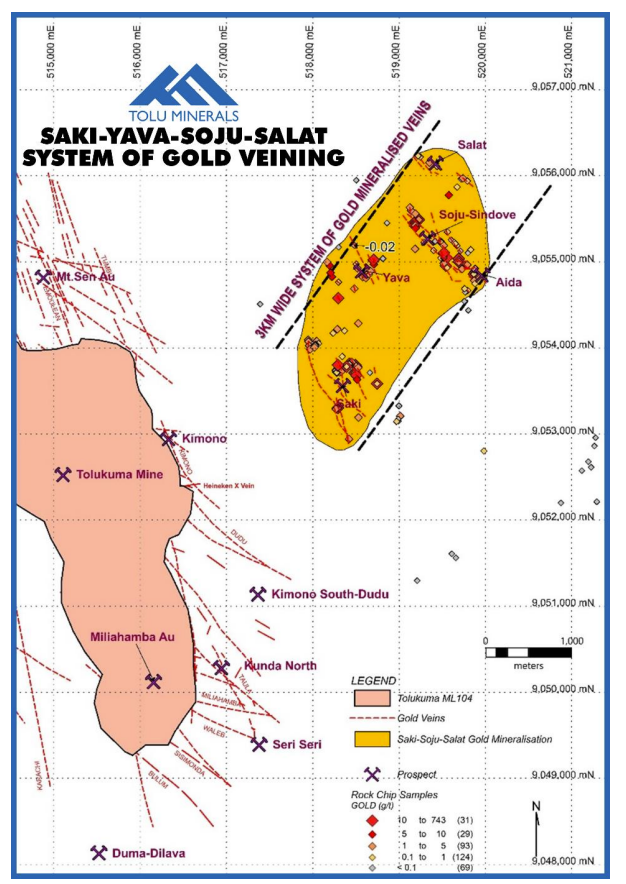

- Saki-Salat system offers 3000m wide x 800m off mine target

- Kimono has 1000m vein system target in NE

- Combined targets of 2-3moz targets identified around mine

- Longer-term potential much larger

- Encouraging trench and rockchip sampling reinforcing historic drill holes

- Near mine to south and east

- Mt Pence Peni Creek Prospect

- Third program being mobilized at Tolukuma mine site

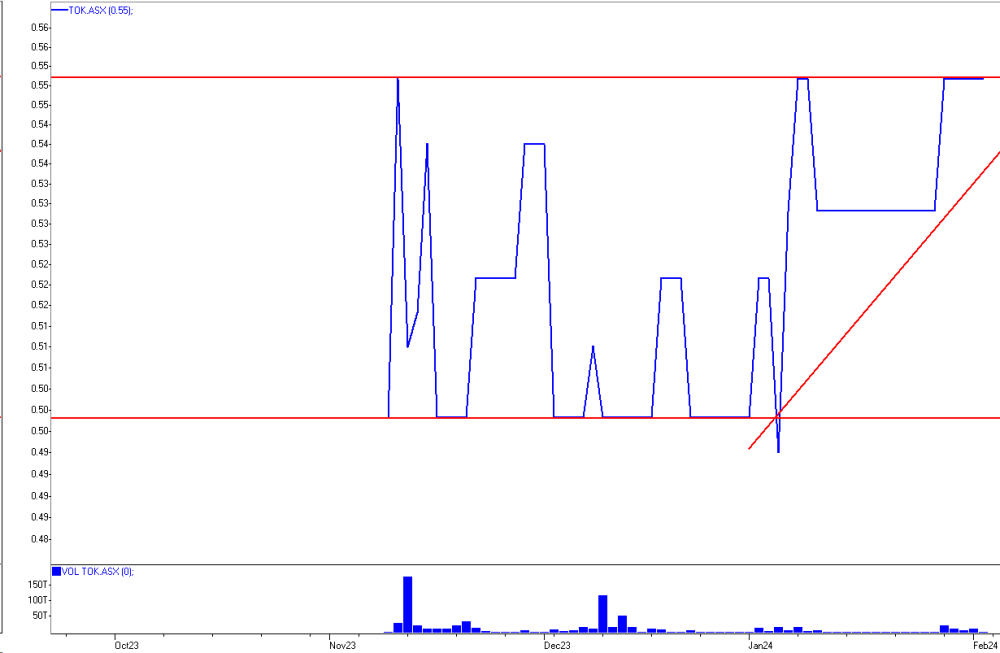

- TOK.ASX market cap AU$64m at AU$0.55 on 116m shares

- AU$12.6m cash at end Dec 2023

Tolu Minerals was successfully listed in November 2023 after raising AU$17m and is currently 10% above its listing price of AU$0.50.

PNG is a difficult place, but as is so often the case, localized disorder and often difficult politicians divert from the uninterrupted progress of operations in remote locations.

The Tolukuma Mine is critical to the Tolukuma villages, so it is strongly supported.

A similar story comes from K92 Mining where its stock price is resuming that strong six-year uptrend.

Tolu Minerals has quickly moved in the process of transforming the Tolukuma Mine from care and maintenance into resumed operations.

Key staff have been recruited and are onsite.

The company has found that much of the existing equipment is in better shape than assumed, and now work is underway:

- Refurbishing accommodation to support an increased workforce

- Refurbishment of administration facilities

- Assessment of various mobile equipment

- Assessment of processing equipment

- Refurbishing and increasing security at the gold room

- Upgrading the staff mess and catering facilities

- Refurbishing power arrangements

- Finalizing pumping operations, including water quality assessment in preparation for dewatering of the mine

Newly recruited mining engineers have been accessing underground to assess power, ventilation, and dewatering solutions.

An important part of the Tolukuma story is the fact that the material balance between ore stope grade, recovered gold grade on ~1moz historic production, and the tailings grade leaves at least 10% unaccounted for.

TOK considers that gold in muds on drive and stope `floors' makes up that 10% (100,000oz on 1moz historic production), and once the 1200m draining decline is established sometime in 2025, these floor muds on all levels can be washed down this decline to settling ponds for gold recovery.

Assessment has commenced on water and muds quality and solids content to provide data on water neutralization and recovery of any potentially contained precious metals.

Very pleasingly, the work on the 23km of new link road is >30% complete, and hopes are for a completion date ahead of August 2024. The new access road is the keystone for the reopening of the Tolukuma mine for substantially reducing costs and facilitating surface access.

TOK noted that previous owner accounts had indicated that helicopter and diesel costs were around 60% of operating costs, and this is 3-4x higher than in comparable mines elsewhere. Tolukuma should become a high-grade AND low-cost mine.

The gravity circuit of the mill will be quickly refurbished to allow TOK to take bulk samples of ores from identified stopes for early processing.

Ore grades for the first decade of operations at Tolukuma were >20g/t, with much being recovered by gravity.

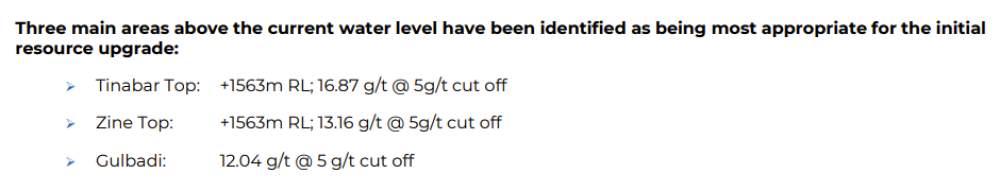

Stopes with resources above the current water level that will be accessed for bulk samples include:

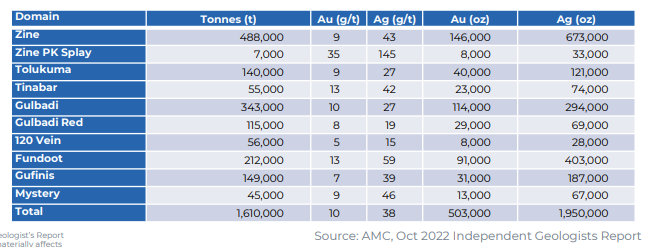

The total existing resources are 1.6mt at 10 g/t for 503koz.

Bulk sampling will confirm grades, and additional drilling should be able to increase these resources as the water level is pumped down.

TOK is expecting to be able to produce a significant amount of gold from late 2024, whereby 10,000ozs from possibly 20,000t at 15g/t net recovered through the gravity plant is AU$30m revenue at costs well under AU$1000/oz (revenue of AU$1500/t less ~AU$500/t of ore costs giving AU$1000/t margin ).

AU$1000 margin on 10,000oz is AU$10m cash surplus.

Two completed exploration programs.

TOK had carried out surveys in 2023 pre-listing and released results in mid December.

- Tolukuma near-mine exploration

The Tolukuma Gold Mine produced ~1.0moz at15 g/t from high-grade epithermal veins on ML104 with a 4:1 silver:gold ratio.

The main veins were running NNW-SSE with a number of high gold content cross veins that included the Tinabar and the prolific Gulbadi structures.

Mining in the first decade had mine grades of >20g/t whilst later mining carried out without sufficient exploration or development fell to 6-8g/t to give the average of 15g/t.

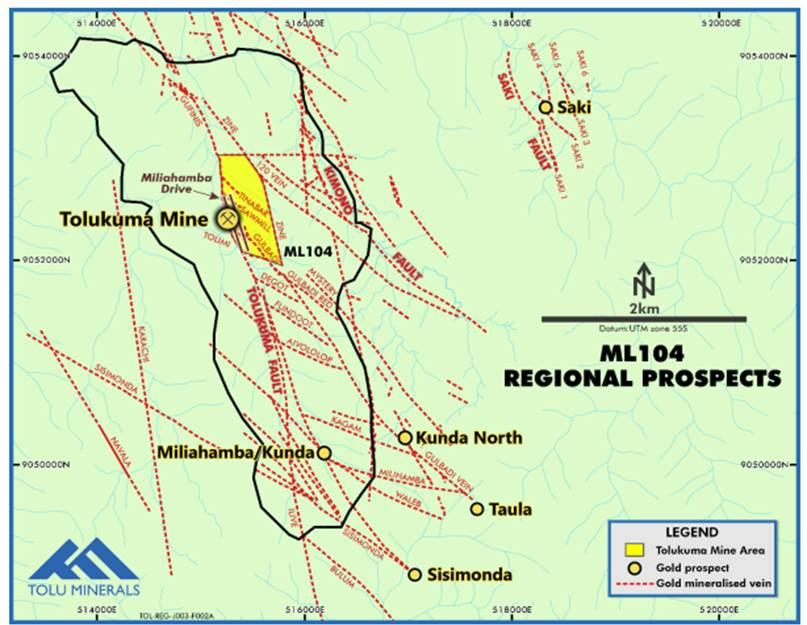

The Tolukuma gold mine veins have so far shown strong continuity over about 1500m, and high grades have been noted in surface sampling and drilling that confirm the continuity of the veins to the south, and sub-parallel veins are also showing high grades at surface, and in drilling.

The Tolukuma Gold Mine area has been prolific with this 1.5moz endowment but is only a very small proportion of the overall Tolukuma region structural system.

High grades have been continually encountered across the region and suggest this will become a major multi-million oz gold deposit.

The Saki system to the east is underexplored, but it also has high grades, and a small 128koz resource at 2.0g/t was defined by Frontier Resources prior to the sale of the tenements to Tolu Minerals in the IPO.

Frontier had also identified a Saki target of 0.6-1.0mt at 5-9g/t for 100-300koz.

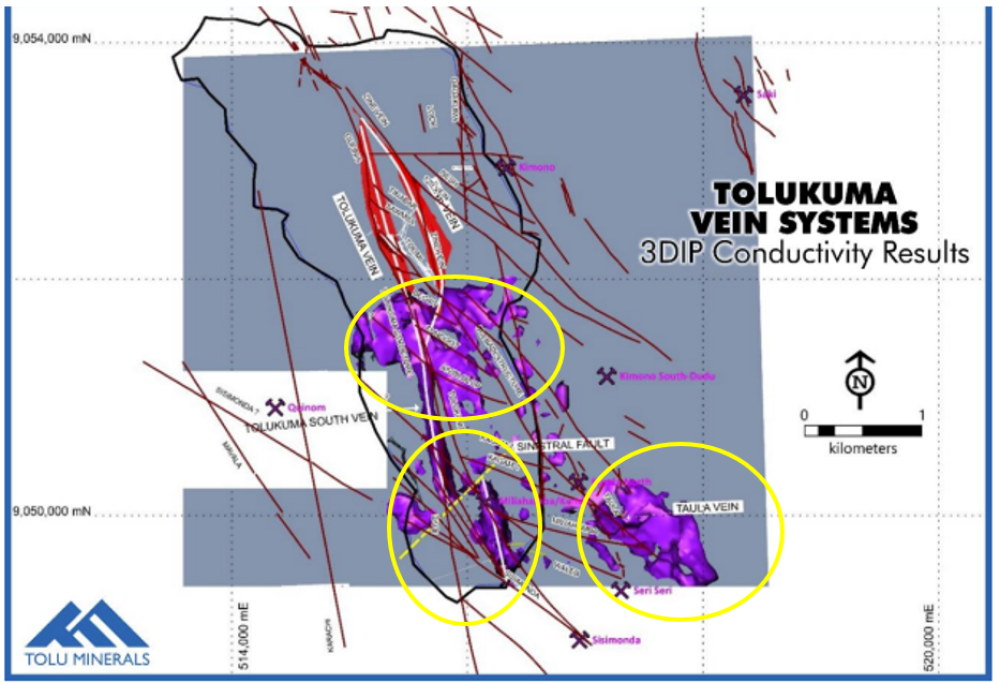

TOK had carried out 3D IP surveys that provided strong evidence of conductivity, indicating mineralization presence and continuing to depth. The Tolukuma South vein and the Fundoot cross vein are important targets in the first ring.

The Maliahamba Drive will be extended through Kunda down to Sisimonda (second ring). The Gulbadi vein structure continues to the large anomaly at Taula (third ring).

Tolu Minerals also has the Saki-Yava-Solju-Salat system, which has a 3000m wide surface expression with the same NNW-SSE orientation that is noted over 800m strike.

Frontier Resources had earlier identified 100-300koz at Saki at 5-9g/t.

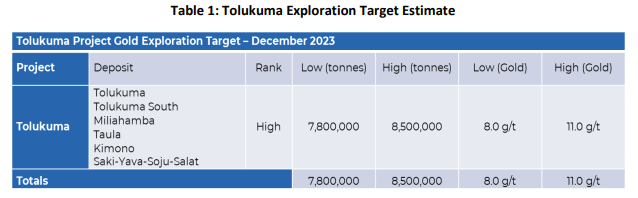

The combined Tolukuma exploration target is 2-3moz, and success here would give consideration to increasing the size of the current 200ktpa mill over time.

Note that:

The low side of 7.8mt at 8g/t = 2.0moz

The high side of 8.5mt at 11g/t = 3.0moz

This would be a substantial increase on the current mine resources of 1.6mt at 10g/t = 503koz.

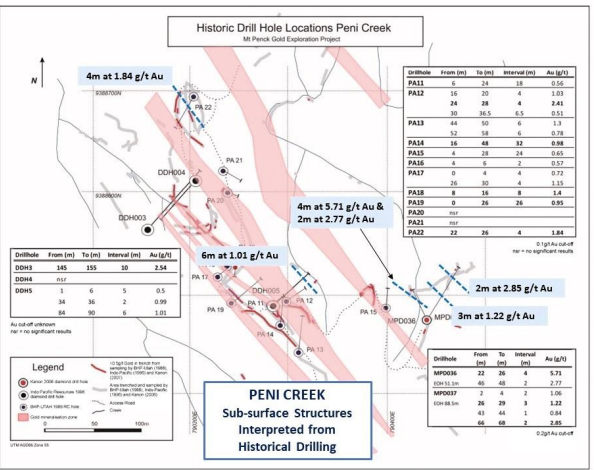

- Mt Penck

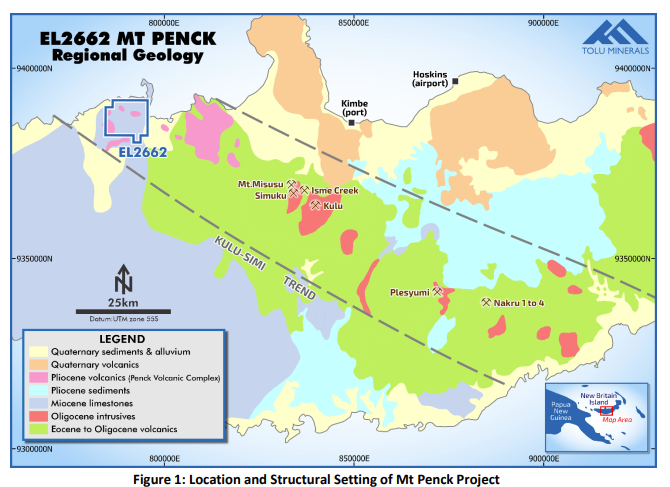

The second exploration program was at Peni Creek at Mt Penck.

Tolu has the EL2662 Mt Penck project on the coast in New Britain, PNG, which sits within the major Kulu-Simi trend.

Mt Penck is a complex epithermal system that exhibits overlapping low to intermediate sulfidation gold-silver and high sulphidation gold-copper mineralization.

These are hosted in volcanics and porphyry intrusions.

This latest program has improved the prospectivity of this already high-potential tenement.

Twelve historical air-core drill holes by BHP-Utah and five diamond holes by others were completed at Peni Creek.

Historical drilling highlights include:

- 4.0m at 2.41 g/t Au from 24m (PA12 - BHP)

- 32.0m at 0.98 g/t Au from 16m (PA14 – BHP)

- 28m at 1.59 g/t Au, incl.

- 10m at 2.54 g/t Au from 145m (DDH003)

- 6.0m at 1.01 g/t Au from 84m (DDH005)

- 4.0m at 5.71 g/t Au, incl.

- 2.0 at 10.05 g/t Au from 22m (MPD036)

- 2.0m at 2.77 g/t Au from 46m (MPD036)

- 2.0m at 2.85 g/t Au from 66m (MPD037)

The historical drilling results suggest the presence of additional mineralized structures in the subsurface that may not have a surface expression.

This could indicate there may be at least 10 separate structures within the Peni Creek target zone.

Historic Drill Hole Data Tolu Minerals Trenching Data

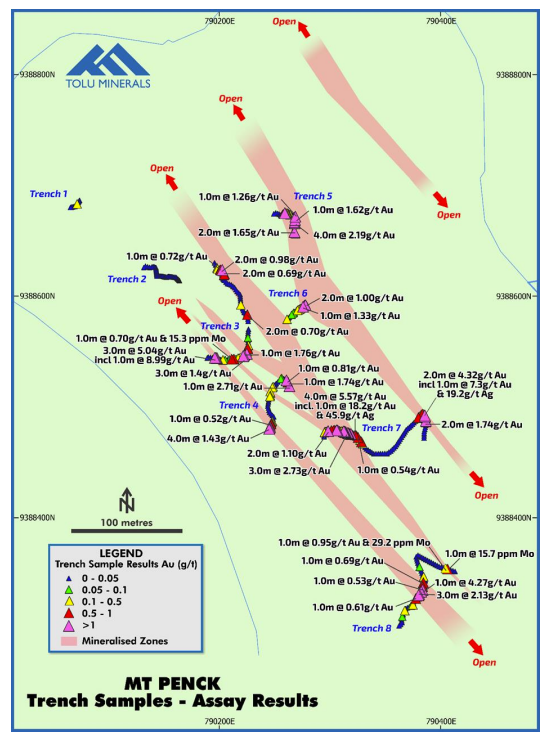

TOK carried out a field survey consisting of 432 trench samples and 171 rock chip samples pre-listing in 2023 at Mt Penck.

The samples confirmed at least seven separate mineralized structures over a 260m wide zone and 460m strike length.

Of the 432 trench samples

- 65 were >0.5g/t including

- 36 >1.0g/t including

- 6 >12.5g/t (max 29.2g/t)

Best trench results included:

- 4.0m at 5.57 g/t Au including

- 1.0m at 18.2 g/t Au & 45.9 g/t Ag

- 3.0m at 5.04 g/t Au including

- 1.0m at 8.99 g/t Au

- 2.0m at 4.32 g/t Au including

- 1.0m at 7.3 g/t Au, 19.2 g/t Ag & 12.5 ppm Mo

Of the 171 rock chip samples

- 15 were >0.5g/t including

- 9 >1.0g/t including

- max 7.29g/t

Best rock chip samples included:-

- PR23076 7.29 g/t Gold + 54.6g/t Silver

- PR23096 60.3 ppm Mo (0.03%)

- PR2300 1686 ppm Cu (1.6%)

Tolu Minerals is making good steps toward emulating K92 Mining's success of strong early cashflows funding a large exploration program.

With a refurbished plant and increased resources and reserves, the mill treating 200tpa at 10g/t = ~65,000ozpa with ~AU$1500/oz margin = ~AU$98mpa = AU$0.84/share cashflow.

Heed the markets, not the commentators.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.